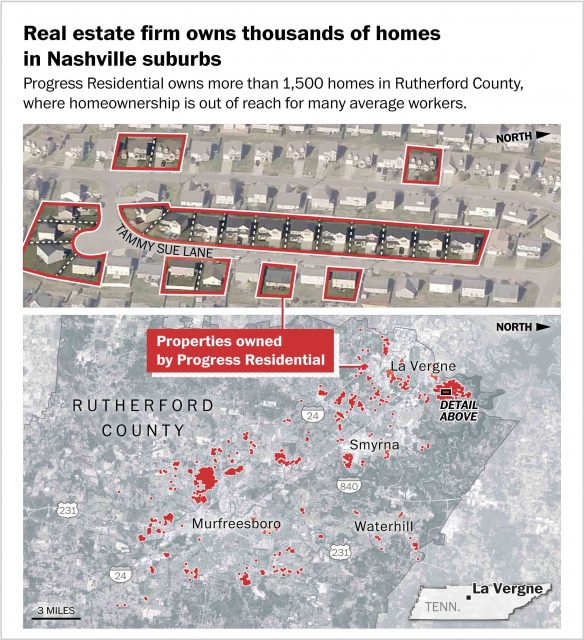

La Vergne, TENN. — The homes on Tammy Sue Lane aren’t fancy. Modest in size and clad in vinyl siding, the houses were priced below $200,000 when most were built about 15 years ago, and for many families in suburban Nashville, they represented a first chance at homeownership.

A corrections officer bought one, and so did a housekeeper and an electrician.

Then some of the world’s wealthiest people bought in.

Over the past six years, 19 of the 32 homes on Tammy Sue Lane have been purchased by a billion-dollar investment venture, part of an unprecedented flow of global finance into the American suburbs. Less than 10 years old, the company has amassed one of the nation’s largest portfolios of single-family houses, renting them to families who cannot afford to buy the “entry level” homes.

The venture, Progress Residential, acquires as many as 2,000 houses a month with a computerized property-search algorithm and rapid all-cash offers. Progress executives boast that the company’s efficient management practices have been a boon to their tenants.

But according to previously undisclosed documents and dozens of interviews with renters and former employees, Progress Residential has been ringing up substantial profits for wealthy investors around the world while outbidding middle-class home buyers and subjecting tenants to what they allege are unfair rent hikes, shoddy maintenance and excessive fees.

“There’s just no human decency,” said Victoria Bates, an Amazon warehouse worker who lives on Tammy Sue Lane with her husband and 10-year-old daughter. Bates said the company regularly failed to fulfill ordinary maintenance requests. While the company said it “addressed” within five days most of the 37 work orders she submitted, Bates said most of the time it didn’t fix what was needed: It took several months for the company to repair a leaky water heater, she said.

Meanwhile, Bates said, the firm levies a profusion of fees that “take advantage of regular people working paycheck to paycheck.”

In a statement, Progress Residential defended its operations, including the treatment of tenants, saying that its rents and fees are in line with industry standards and market rates. Pretium officials said they adhered to the federal eviction moratorium.

“All of our entities conduct business according to the highest ethical and legal standards,” the company said.

Behind Progress Residential is Pretium Partners, a New York-based investment firm whose business plan and investors are revealed in the Pandora Papers, a trove of offshore financial records obtained by the International Consortium of Investigative Journalists (ICIJ) and shared with The Washington Post.

The plan sought to exploit the 2008 U.S. housing crash, which forced millions of homeowners into foreclosure and left a glut of cheap houses for sale. The financiers’ plan called for buying up tens of thousands of these properties at depressed prices and renting them to families who had lost their homes or, because of tightened lending practices, could no longer qualify for a mortgage.

The venture would ‘capitalize on the severe distress in the residential real estate market in the United States,’ according to the pitch memo.

To raise money for the project, Pretium Partners sent confidential invitations to people wealthy enough to put up at least $2 million. Executives projected annualized returns of 15 to 20 percent, according to a 238-page solicitation to investors in 2012. In total, Pretium Partners raised more than $1 billion, and the resulting real estate venture became Progress Residential.

The venture would “capitalize on the severe distress in the residential real estate market in the United States,” according to the pitch memo. The homes would be rented to families “who have been displaced by foreclosure or are otherwise unable to obtain financing despite being able to afford a home purchase.”

Among those who profited from America’s housing crash, according to the documents, was a Cayman Islands trust funded by one of Canada’s most powerful political donors, Stephen Bronfman, an heir to the billion-dollar Seagram spirits fortune. Another was Vikrant Bhargava, who co-founded an online gambling company that debuted on the London Stock Exchange valued at $8.5 billion. Pretium made legal arrangements so such foreign investors would have limited exposure to U.S. taxes, according to tax experts.

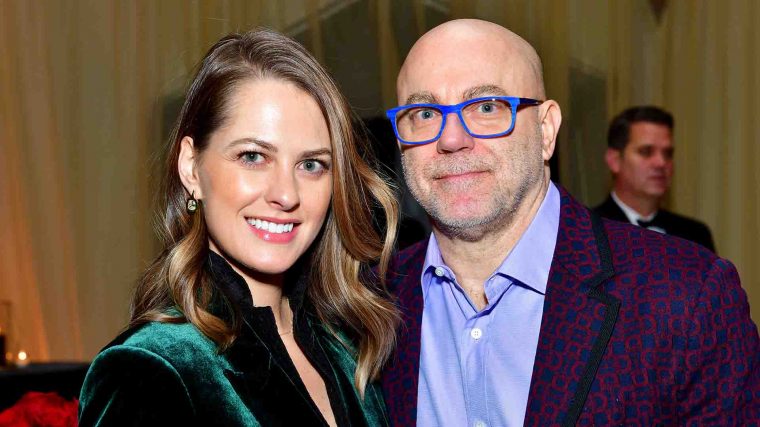

While the documents do not identify most of the other investors, they show that an outsize share of the potential profit was earmarked for Donald R. Mullen Jr., founder and chief executive of Pretium Partners, and others in the firm.

Mullen is well known in financial circles for his tenure at Goldman Sachs, where he helped oversee that firm’s lucrative bet against U.S. housing and mortgage markets ahead of the 2008 crisis. That bet, a strategy popularly known as “the big short,” allowed Goldman to profit as markets plummeted.

With the Progress Residential venture, Mullen bet in the other direction — that the houses it was buying would increase in value. By 2019, according to a press release at the time, the venture had nearly doubled investors’ equity.

While those kinds of profits have inspired admiration on Wall Street, the reaction has been different on Tammy Sue Lane and in other Sun Belt subdivisions where Progress Residential and similar firms are devouring the housing supply and outbidding families. Rutherford County, where Tammy Sue Lane is located, ranked as the fifth-least affordable U.S. county for home buyers when considering wages in the area, according to the real estate data firm ATTOM Data Solutions.

Rob Mitchell, the county property assessor, says nearly 1 in 10 homes there is now owned by a real estate investment trust, and these investments are jacking up house prices.

These ventures are “equity-mining our community — removing generational wealth for an entire demographic of people,” said Mitchell, a Republican elected official. “For the average person starting out wanting to start their family, the choice is no longer: Can I purchase a house? It’s instead: Can I afford to rent a house?”

While buying up block after block, Progress also has been accused of aggressively evicting tenants. Congress is investigating whether Progress and other major rental firms violated a national moratorium on evictions during the pandemic. Sen. Sherrod Brown (D-Ohio), chairman of the Senate Banking Committee, has requested that Progress explain why its pandemic-era eviction filings appear to have fallen more heavily on majority-Black communities.

More than 3,000 people across the nation have joined a Facebook group for tenants called Victims of Progress Residential. The site is an eruption of tenant complaints — about evictions, but also lost security deposits, costly fees, calls that go unanswered, an array of maintenance issues — that echo those of Progress renters in Rutherford County.

“They’re preying on all these people,” said Cindy Hicks, a hospital revenue specialist who lives in a Progress home near Tammy Sue Lane. Hicks said that when she was late on rent the company was quick to file for eviction and charged her a related fee of hundreds of dollars even after she paid up.

“Because of the customer service, we hope to be moving out soon,” said Odera Okafor, an IT worker who lives on Tammy Sue Lane with his wife and 12-year-old child. In just a few years, he said, he’s had repeated problems with an air-conditioning unit that froze and plumbing issues.

“I can’t tell you who is behind Progress Residential. All we can tell you is it’s been bad,” said Ashley Baltimore, a delivery driver who, with her husband, rents one of the company’s houses on Tammy Sue Lane for $2,020 a month. That’s up more than 30 percent from when they moved in in 2016, roughly in line with the area’s rapidly rising rates.

In a statement, Pretium Partners said it treats tenants fairly and promptly responds to their complaints. The company said the tenants who complained to The Post and ICIJ constituted a very small portion of its 200,000 residents.

“Pretium is dedicated to being a part of the solution to our nation’s housing crisis through unparalleled efforts to support our residents and communities,” the firm said.

The allegations of mistreatment “lack underlying evidence and are based on unsubstantiated or anonymous claims,” the company said, adding that they are not representative of the experience most tenants have in the company’s more than 70,000 houses. The company said the eviction case against Hicks had been dismissed; that while the maintenance issues at Okafor’s house required “persistent work,” he’d been given a $300 credit; and that “repeated and timely visits were made to Ms. Bates’ home to address maintenance issues.”

“As it is impossible for us to engage constructively under such one-sided circumstances, we instead reiterate Pretium’s commitment to providing high-quality, affordable housing and dependable service for households that choose to rent.”

Mullen did not respond to requests for an interview made through Pretium.

Bhargava said that he was only vaguely aware of his investment, which was made by his Singapore-based family trust.

Bronfman, who, along with his billionaire father Charles, invested tens of millions of dollars in a Cayman Islands entity known as the Kolber Trust, had no involvement in the original decision to invest in Pretium, said Zeno Santache, chief financial officer of Bronfman’s private equity firm, Claridge Inc.

“Stephen Bronfman and his corporations don’t control the Kolber Trust,” he said in an interview, referring to the Caribbean entity. “We have no idea what their investments are.”

Cashing in on the American Dream

For decades, the majority of homes in places like Tammy Sue Lane were owned by their occupants, providing financial stability to millions of families.

Enthusiasm for individual homeownership in the United States was so strong before the housing crash that much of government policy was aimed at expanding it to as many families as possible. By 2005, the U.S. homeownership rate had risen to as high as 69 percent, according to figures from the Federal Reserve.

At that time, proposals to buy up thousands of homes were spurned by investors who feared being seen as “trampling on the homeownership dream,” said Brett Christophers, a geographer at Uppsala University in Sweden who has studied the phenomenon.

The housing crisis, though, weakened the grip of the middle class on homeownership. Easy credit and Wall Street’s appetite for risky mortgages had created a bubble in the markets, and when it popped, millions of families paid a price. In 2008 alone, lenders foreclosed on the loans for more than 3 million homes. Home prices sank.

The economic wreckage led conservative economists to argue that U.S. government policy to expand homeownership had been misguided, and that many families had been encouraged to buy homes they couldn’t afford. That ideological push, plus a glut of cheap houses and new technology simplifying the management of thousands of properties, prompted several investment groups to take the plunge into massive house-rental ventures, Christophers said.

These new corporate landlords present serious competition for aspiring home buyers like the Baltimores. The couple has been seeking for years to buy an affordable house for themselves and their three children, now 11, 7 and 6. They want what many families want: good schools and a quiet neighborhood.

Global investors, it turns out, were shopping for the same.

The Progress business plan specified that the fund preferred homes built in the last 15 years and priced between $70,000 and $190,000.

“The common characteristics … will be suburban locations, family oriented neighborhoods, low crime rates and close proximity to good schools and employment opportunities,” according to the solicitation to investors.

The Nashville area is rich with such housing. La Vergne, an outer suburb on the shores of a scenic reservoir, has seen its population more than quadruple since 1990, growing to more than 35,000 residents. On Tammy Sue Lane and some other streets in La Vergne, the landscape still looks freshly cleared — if a yard has trees, they’re often spindly.

“These funds have really concentrated on suburban areas that have seen a lot of growth, places where people are moving,” said David Szakonyi, co-founder of the Anti-Corruption Data Collective, which analyzed thousands of Progress’s house purchases around the country, finding heavy concentrations in Sun Belt suburbs. “These are homes for people in entry-level jobs, recently out of college, or making lower wages and looking for a single-family home for their families.”

While the Baltimores and Progress Residential have been looking at the same kind of houses, the investment venture holds significant advantages when it comes to sealing a deal.

One is speed.

Within 15 minutes of a house appearing on the Multiple Listing Service real estate database, the company’s computers assess whether it should be flagged for review by the company’s acquisition team, Chaz Mueller, then Progress Residential’s CEO, said in an interview on the “Leading Voices in Real Estate” podcast earlier this year.

Within two hours of the listing, Progress can make an offer.

The company is buying “close to 2,000 homes this month,” Mueller said on the podcast, “and we expect that to increase.”

Another advantage: Progress chooses houses strictly on the numbers, while a family’s decision is more complex.

Mueller contrasted the company’s methods to those of families that might, under pressure, overpay for a home. Progress is “completely not emotional,” Mueller said. “We’re very financially oriented and not emotional about everything we do on this acquisition process.”

Progress’s most significant advantage, however, may be its ability to make all-cash offers, and quickly. A typical buyer must borrow money, and the financing arrangements can add uncertainty and delays.

All those advantages pay off for investors: In an analysis of more than 70,000 sales of single-family dwellings, university researchers showed that investors paid about 10 percent less than an individual buyer for a similar house.

The investors “have cash and the power to negotiate,” said Professor Abdullah Yavas, one of the researchers and the academic director of the Graaskamp Center for Real Estate at the University of Wisconsin. “They’re going to get a better price.”

That’s tough news for families such as the Baltimores. In May 2016, the couple had arranged to buy a house in nearby Smyrna when their financial arrangements fell through. The Tennessee Housing Development Agency said they made too much money to qualify for down payment assistance, while lenders said they made too little to qualify for financing, the Baltimores said.

They’ve bought everything up, and that limits the opportunities for anyone else trying to buy a house. — Ashley Baltimore

With that, they moved into a house on Tammy Sue Lane — as renters. The plan was to wait a few years, save up some money and try again. Their rapidly climbing rent payment has left less to put away for a down payment. Meanwhile, local house prices are soaring.

When they were looking to buy, “there were more houses for sale,” Ashley Baltimore said. “Now those houses have been taken over by Progress. They’ve bought everything up, and that limits the opportunities for anyone else trying to buy a house. We’re still going to try.”

An executive at Pretium Partners dismissed the idea that owning and renting are significantly different. Whether they’re renters or homeowners, people still must make a monthly payment — for rent or for a mortgage, Dana Hamilton, Pretium Partners’ head of real estate, said on the real estate podcast.

“I laugh because when people try and distinguish owning a home from renting a home, the reality is most people don’t own a home — they rent the home from the bank,” Hamilton said. “From the outside, it really looks the same.”

One key difference unacknowledged in her remark, however, is that a family’s monthly mortgage payments can build equity in the home; rent payments have no such benefit.

Hamilton said in the podcast interview that Pretium chief Mullen deserves praise for anticipating the needs of a wave of millennials who don’t have the means to buy a house. “He basically saw a generation coming and said, ‘How are we going to house them?,’ ” she said.

A large investment group, she said, “is in the very best position to provide residents with a living experience that they simply can’t provide for themselves at a cost that they can actually afford.”

A billion-dollar bet

The Pandora Papers contain Mullen’s first pitch to investors. It set out how they could achieve big returns, while minimizing taxes, by buying houses at discounted prices in the wake of the foreclosure crisis. In the near term, investors would enjoy healthy yields from the booming rental market, the pitch said; eventually, as housing prices rose, they could sell at a huge profit.

An analysis by the ICIJ and The Post shows that Pretium’s investors did indeed see substantial gains from their bets on renters on Tammy Sue Lane and elsewhere.

In April 2013, a Bahamas-based firm controlled by Bhargava’s Singapore trust agreed to invest in Pretium. The former online gambling executive’s trust eventually contributed $6.6 million. By September 2018, the overall value of the investment had increased to $9.4 million, according to account statements in the Pandora Papers.

In a written statement, Bhargava said the investment had achieved a 10.35 percent “internal rate of return” — a common annualized performance measurement used by the fund — by the time the trust exited the venture in 2019. By comparison, the average annual return in stocks, as measured by the S&P 500 Index, has run about 10 percent historically.

According to an expert who reviewed the Pretium fund’s offering documents, the fund used a series of complex legal arrangements to aggressively shield profits from U.S. taxes.

First, money from foreign investors flowed into a partnership in the Cayman Islands, where it didn’t trigger the need to file U.S. tax returns, said Reuven Avi-Yonah, a law professor at the University of Michigan specializing in international taxation.

The Cayman Islands partnership then sent the money to a “domestically controlled” entity in Delaware, allowing investors to avoid steep taxes imposed on foreigners who profit from the sale of U.S. real estate, Avi-Yonah said.

The Delaware entity, in turn, invested the money in real estate investment trusts (REITs), which serve as legal owner of the rental houses. REITs are not required to pay taxes on earnings from rental income.

Asked about the tax arrangements, Pretium Partners said that “our investment vehicles are structured and managed in accordance with industry best practices.”

In a statement to ICIJ and The Post, Bhargava said he has fully complied with relevant tax laws. Bhargava said the trustees managing his family trust chose to invest in Pretium and that he has not had access to the proceeds. He said trustees were unaware of the taxes the Pretium fund may have paid in the U.S. In Britain, where he lives, he said he is not required to pay taxes on income outside the territory because he is a “non-domiciled resident.” And in Singapore, where Bhargava’s Pretium investment ultimately was held, there generally is no tax on profits from the sale of investments.

For Mullen, Pretium’s founder, the legal arrangements provided tax benefits, too. Like other private equity ventures, Progress is designed to return to its executives a share of profits out of proportion to their original investment, which in this case was $25 million.

ICIJ and The Post could not determine exactly how much Mullen has made from the fund, partly because his earnings depend on the level of investor returns, according to the investment pitch. If the venture achieves 17.5 percent, the middle of its projected return, the payday for Mullen and other fund managers could be more than $1 billion, according to Emmanuel Yimfor, assistant professor of finance at Michigan University’s Ross School of Business, who reviewed the documents.

If other investors saw returns similar to Bhargava’s roughly 10 percent, the Pretium managers would still see substantial earnings — around $230 million, according to Yimfor.

This outsize share of the profits is essentially compensation for managing the fund, but it is not taxed as regular income. Instead, such profits, known as “carried interest,” are taxed at the much lower capital gains rate.

The carried interest tax break has long been controversial. According to the Congressional Budget Office, it deprives the U.S. Treasury of more than $1 billion a year in lost tax collections.

Harvesting fees, at renters’ expense

Even as the investors piled up substantial gains, Progress Residential was treating some tenants unfairly, according to several former employees.

“I feel terrible about working there,” said Meghan Cook, who handled service calls from the Nashville area, including Rutherford County. “No one should be treated the way they treated their residents.”

The company often forced tenants to pay for home repairs even when the damage should have been covered by the company, she said. “There was no ‘We’re sorry this happened,’ ” Cook said. “They had no compassion. It was ‘Pay it or you’re going to be evicted.’”

Cook said she resigned in July 2020 and later worked for a different corporate landlord, where she said she encountered similar problems. She has since switched careers.

In response to Cook’s account, Progress said, “we categorically reject this unfounded assertion, which is completely false and grossly misleading.”

Four other former employees said Progress often refused to relinquish security deposits, even when a tenant left a house in good shape. The company said the employees’ claims are factually inaccurate, adding that “it is impossible for us to respond to vague and unsubstantiated claims.”

Progress also embeds an array of fees and penalties in the provisions of the leases tenants sign. In a lease on Tammy Sue Lane, for example, tenants are required to pay: 10 percent of the rent if the payments is more than five days late; $7.95 a month for a firm picked by Progress to collect utility payments; $9.95 a month for failing to buy renter’s insurance; and a $35 “convenience fee” each time rent is paid with a credit card.

If the company sends out a maintenance crew, Progress charges a $75 fee unless Progress determines the repair to be its own responsibility. If the company files an eviction case, Progress charges tenants a $200 “eviction administration” fee, according to the lease.

The standard lease the firm uses across the country “is about as punitive as we’ve seen from the larger private equity landlords,” said Lindsey Siegel, director of housing advocacy at Atlanta Legal Aid Society, which often helps Progress Residential tenants. “The leases are just another way to make money.”

The firm said its fees “adhere to basic industry standards, and, in many cases, are much lower than the fees charged by smaller landlords, who have fewer resources and tighter bottom lines.”

Pandemic evictions

Tenant complaints about Progress Residential drew relatively little attention until the coronavirus pandemic. Then, in September 2020, the Centers for Disease Control and Prevention issued an order protecting tenants across the country from eviction if they provided a signed statement to their landlord affirming that they could not pay the rent.

Citing reports that Pretium Partners and other landlords continued to evict tenants during the moratorium, congressional committees in June opened inquiries.

Pretium Partners filed to evict more than 1,200 of its renters in the first half of this year, before sharply curbing the practice once the congressional review began, according to the Private Equity Stakeholder Project, a nonprofit organization that monitors financial firms. In Rutherford County alone, the company filed evictions against 121 households during the moratorium and obtained eviction orders for at least 51 of them, according to an analysis by the Toronto Star, a reporting partner of The Post and ICIJ.

Progress has not been cited with violating the eviction prohibition. The company said it has “always complied with the CDC moratorium — no resident covered by a valid CDC declaration has ever been evicted from our homes for non-payment of rent.” It also said that the Private Equity Stakeholder Project “is pursuing a decidedly biased agenda.”

“During the COVID-19 crisis, Pretium has facilitated over $60 million in assistance for thousands of residents, including rent forgiveness and relocation assistance,” Pretium said in a statement.

Valerie and Mark Gitt are among those Progress sought to evict during the CDC moratorium, which lasted to August of this year.

Mark Gitt, 58, does quality-control inspections for plumbing in hotels and other big projects. Valerie Gitt, 54, is a former paralegal who is disabled with a spinal ailment. The couple shared their home with Valerie’s 82-year-old mother, who had been diagnosed with lung cancer.

After Mark was laid off early in the pandemic, Valerie told Progress that they might have a hard time paying the $1,600 monthly rent, she said.

“They said, ‘Oh, we’re going to work with you. We’re going to help you. Just pay what you can,’ ” Valerie said.

The couple said they made partial payments as their finances allowed. But in late September 2020, Progress filed court papers seeking their eviction.

They weren’t alone. When Valerie arrived for an October court hearing, there were several other Progress tenants in the courtroom. The judge set a separate date for her case.

On Dec. 15, a judge ordered the Gitts to be evicted.

A few weeks into January, Progress obtained a “writ of possession” ordering the sheriff to remove the couple from their home. A deputy sheriff showed up soon after to warn them they would be forced out if they didn’t leave voluntarily.

About this time, the Gitts discovered that to benefit from the eviction moratorium, they needed to file CDC paperwork with Progress, Valerie said. No one had told her about this requirement, she said.

The family signed the paperwork on Jan. 21 and Valerie sent a pleading email to Progress: “Please don’t evict us, we are doing the best we can.”

Progress said that when it received the Gitts’ paperwork it “promptly” dropped the case and told the Gitts that the eviction would be reversed.

But Valerie said she was never told the eviction order had been cancelled. Otherwise, she said, they would have stayed in their home.

In late January, the Gitts said, they left under the assumption that they were about to be forced out.

Meanwhile, they said, Progress is asking them to pay $28,000 in back rent and fees.

“We paid them what we could. But they treated us like scum,” Valerie said. “Something needs to be done about how they treated people.”

Contributors: Robert Cribb, Marco Chown Oved, Agustin Armendariz