L.A. County is among least affordable housing markets

Looking for the American dream in Los Angeles?

Good luck with that.

A household earning the county’s median income — $53,001 annually in 2012— can only afford a home worth about $271,000, a price point better suited to the Midwest than the West Coast. That means a typical buyer can afford only 24% of the homes currently for sale, according to a study released Thursday by Trulia, the real estate information company.

Los Angeles County is the nation’s third-most-expensive housing market by this measure — behind only San Francisco and Orange County. The New York City metro region ranked fourth. Last year, a household earning the L.A. County median could afford 39% of homes for sale.

“The housing recovery has benefited some people more than others,” said Trulia chief economist Jed Kolko. “A lot of the income gains in recent years have gone to the top percentage of households.”

The house-hunting odyssey has gotten much tougher over the last year, as the median home price in the six-county Southland has shot up 24.6%, to $385,000 in August, far outpacing growth in incomes. The Los Angeles County median has risen 28.1% to $429,000.

For many, the search is maddening.

Earlier this year, Chris Benner searched online for a house priced between $275,000 and $375,000, looking from the San Fernando Valley south to San Pedro.

“We came up with less than 10 matches that we would even think of looking at,” the 42-year-old freelance associate producer said.

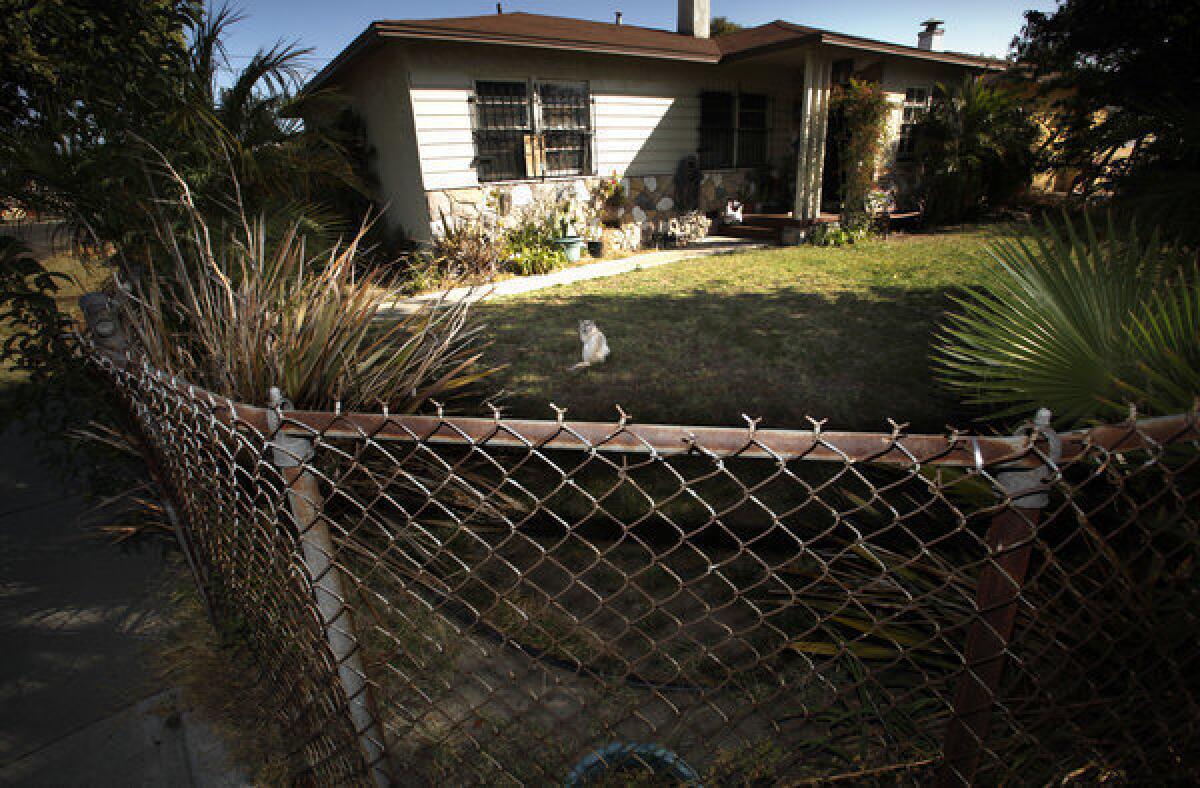

In April, he and his wife purchased a four-bedroom fixer-upper in Athens, an unincorporated area east of Hawthorne, for $297,000. The Benners make far more than the median household income — about $95,000 last year between them, Chris said — but it’s still tough.

“We don’t save a penny,” he said. “For people only on one income — $50,000 or $60,000 — I don’t see how they can possibly do it.”

Chad Sells agrees. The 31-year-old would like to move out of his two-bedroom Pomona apartment and purchase a house — a steadier environment for his 6-year-old son. But the single parent sees no way into the housing market on his $53,000 income as an information technology specialist.

“It just seems impossible,” he said.

The Trulia analysis assumes buyers get a 30-year fixed mortgage at a rate of 4.5% and put down 20%. The analysis also includes property tax and insurance. Housing is deemed affordable if it costs less than 31% of the median household income.

Many middle-class families simply pay more than that, money that could have been spent elsewhere, stimulating the economy.

“A lot of people spend 40% on their housing” in Southern California, said Richard Green, director of USC’s Lusk Center for Real Estate.

Buying an affordable home can come with wrenching trade-offs — renovations, poor schools, long commutes and sometimes more crime. Benner sends his 7-year-old son to a public school in Culver City, where the district allows transfers for parents who work there.

The definition of an affordable “middle class” home varies across the region, according to the Trulia analysis, which matches median incomes in individual counties or metropolitan areas with home listings on its site in the same area.

In working-class Watts, $280,000 will get you a three-bedroom house on Zamora Avenue. The home — built in 1944 — is 1,469 square feet, according to a Trulia listing. Photos with the advertisement show bars on the windows.

In Lancaster — with its desert climate and long commute to most employment centers — the same price would buy a six-bedroom house on Amethyst Street with vaulted ceilings built in 2004.

Many areas appear almost completely off-limits to median-income buyers.

In the South Bay and Westside, just 16% of homes currently for sale are within reach. In Pasadena and the San Gabriel Valley, just 12% of homes qualify as affordable by Trulia’s standards.

The central part of the city of L.A., by comparison, has much more affordable housing — and yet still only 30% of for-sale homes meet the affordability standard.

Kevin Portnall, a 53-year-old grocery store cashier from San Pedro, doesn’t see homeownership in his and his wife’s future.

“I have pretty much given up,” said Portnall, who makes roughly $50,000 a year. “There is just no hope.”

In Orange County, the situation is worse. The median income is higher, but affordable housing is even more scarce.

A household earning the median, $71,983, could afford only 23% of the houses on the market this month, according to Trulia. Those looking for an affordable house will have better luck in the northern part of the county.

Declining affordability is driven not only by rising values and higher mortgage rates but also a shortage of homes for sale. Investors have scooped up many lower-cost homes, including foreclosed properties, to rent or rehab and sell at higher prices. Many owners in more affordable neighborhoods remain underwater — owing more on their homes than they are worth — limiting their ability to sell.

The number of homes in Southern California that sold below $300,000 fell 24.9% in August compared with last year, according to research firm DataQuick.

The lack of affordable housing in California creates a drag on the economy, said Christopher Thornberg, founding partner at Beacon Economics. Businesses and the public sector must pay employees more, he said, hampering the bottom line and swelling state and local budgets. Manufacturers, he said, have a tough time finding workers.

Some residents simply give up.

“Folks who want a house — but can’t afford one — leave,” Thornberg said.

Benner, who grew up in Inglewood, knows that dynamic well.

“Most of my friends, who make a lot [more] money, have left the state,” he said. “I am probably the only one still sticking it out.”