Many argue that China’s soaring housing prices are due to a squeeze in housing supply. But a new report by Anne Stevenson-Yang, co-founder of Beijing-based J Capital Research, puts more firepower behind the argument that China has too much housing, not too little. “There is no city in the country without stretches of terrifyingly empty towers,” she writes.

The housing glut isn’t just evident in backwater parts of the country. Even in central areas of Beijing and Shanghai “ghost developments” have popped up, reports Stevenson-Yang. That’s even as prices on commercial homes in mega-cities surged again in September:

Empty apartments in plum plots of Shanghai and Beijing are one sign that people aren’t wanting for new apartments. Another is that the home ownership rate in China is already high. While the Chinese government reported home ownership of 90% in 2010—compared with roughly 65% in the US—the rate is likely to be much higher in many cities, writes Stevenson-Yang. That’s in part due to the fact that many own multiple homes, particularly in smaller cities. For instance, a local developer in a mid-sized Hebei province city told Stevenson-Yang that home ownership rates were at 200%.

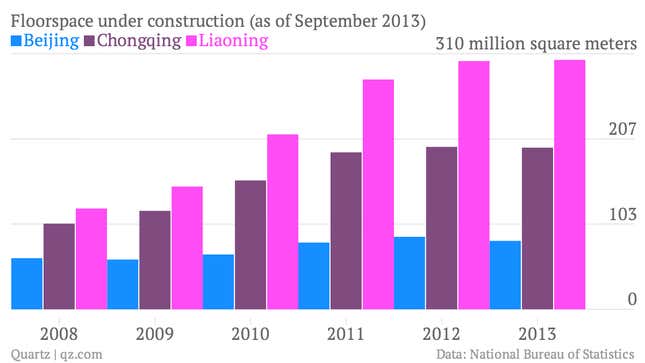

Even with home ownership at unheard of rates, construction continues apace. Here’s a look historical residential construction trends in Beijing, Chongqing and Liaoning province:

What’s driving home price increases, if not a dearth of supply?

As we’ve discussed before, since the government won’t let its people invest in much of anything outside China, and because stocks are notoriously volatile, the most popular store of value is apartments.

In China’s housing market, renting a new apartment actually erodes its resale value. A good chunk of the demand for houses has little to do with how many places to live Chinese families actually need. By divorcing homes from their practical value, the market has made it easier to ignore a home’s fundamental worth. That’s probably why “the individual owners of the housing mostly do not yet know that the swollen asset they are sitting on is not worth anything near its quoted price,” as Stevenson-Yang writes.

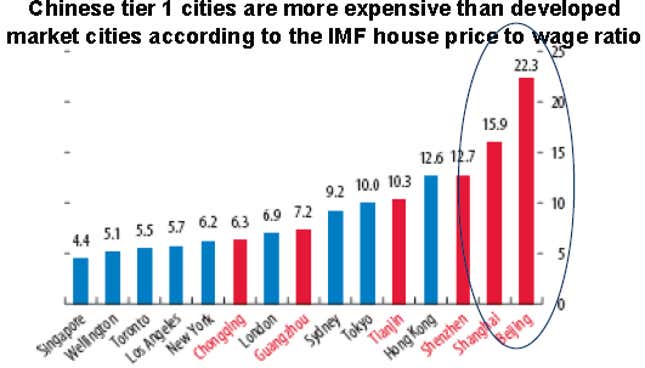

That’s scary since people already have most of their savings tied up in their homes. Here’s a comparison of home prices and household income in various Chinese cities:

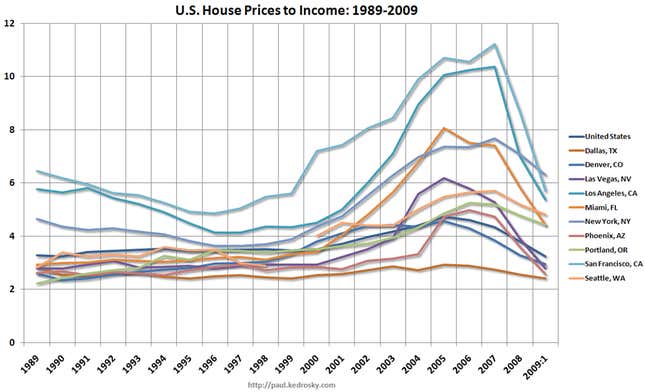

The same comparison in the US pre-financial crisis is much lower:

At some point, people will have to start questioning the value of empty, un-rentable housing. When that happens, prices will collapse, taking a lot of hard-earned savings with them.