Skift Take

The smart mobility actors will continue to mesh territories and deploy their technology and services in each major cities of the world, before connecting them through a unified offer. That's the revolution happening right in front of our eyes right now.

Editor’s Note: Skift recently started a three-part series on the digital and mobile transformation of transportation, the changing face of cities, and how they both have the potential to upend everything we know about travel.

The first article in this series introduced the mobility era and how mobility providers and aggregators have created new transportation products and services in cities all over the world. The second part introduced us to the technology innovations that are making the new mobility era possible.

The third and last part, along with a 90-slide presentation by the author, is below, and well worth a deep read. You will find all articles in this series here.

The fourth generation revolution in the travel industry has already started. In 2015, the disruptive forces will join to form a nexus, resonate and shake the whole travel ecosystem, again. This last article in a series of three presents some of the key forces of this transformation and how it could disrupt the existing travel ecosystem.

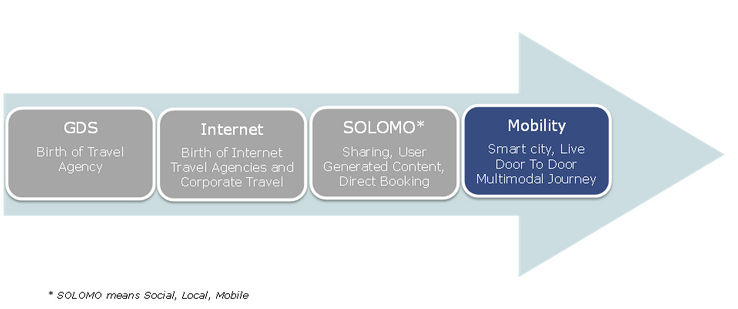

The Travel Industry Has Already Experienced 3 Digital Revolutions

The first revolution started in the 1960’s, fueled by the commercial development of air transportation under the IATA umbrella, which led to the creation of Computerized Reservation Systems (CRS).

CRS were a huge leap forward enabling the airlines to instantly look up availability throughout their network. But airlines soon realized that their core business was not to create and manage such systems. Their main needs were to make their inventory visible everywhere at the lowest cost and to ensure some fairness in the process, assuming information will be the same everywhere.

CRS were a huge leap forward enabling the airlines to instantly look up availability throughout their network. But airlines soon realized that their core business was not to create and manage such systems. Their main needs were to make their inventory visible everywhere at the lowest cost and to ensure some fairness in the process, assuming information will be the same everywhere.

It lead to the birth of Global Distribution System (GDS) and heralded the golden age of travel agency industry. It grew agencies revenues by up to 400 percent, while requiring employment growth of only 20 percent, according to estimates by Phocuswright.

The second travel industry revolution started with the rise of the World Wide Web on top of the growing Internet network. The Online Travel Agency (OTA) phenomenon shook up the whole ecosystem by offering to the traveler the capability to compare and book fares online, without having to visit a brick and mortar travel agency.

This revolution of online disintermediation happened in a very short time, from the mid 1990s to the mid 2000s. These companies, focused on the end travelers, understood very quickly that the building up their own supply chain was also key to their offering. They started to offer tools and incentives to hotels, tour operators, car rental companies to fill their inventory: “Content was now king”. They especially targeted the inventory that was not available in the GDS systems.

The third revolution resulted from the expansion of Internet, as it added the capability to access Internet from mobile and add to it the wisdom of crowd. Social, Local, and Mobile (SoLoMo ) led to creation of companies like TripAdvisor (user ratings), Hotel Tonight (mobile only, last minute hotel booking) or Timista (personalized and real time information about what’s going on now in London). It was also the beginning of the sharing economy, a major disruption force, which led to companies like AirBnb or Uber.

On the business travel side, the disruption came from corporate online booking tool providers, that started to capture all the benefits on top of GDS, travel management companies (TMCs) and corporate clients. Travel was for these new players, and still is, a trojan horse to help sell their expense solution, in the cloud. Expense and payment solutions are still the “cash cows” of the corporate travel industry. So why bother selling trips after all?

The “Open Booking” movement was born. The motto being: “Book everywhere, but expense and pay with us!” Mobility providers and hotels could then get direct booking and could disintermediate GDS and TMCs.

This revolution has lasted nearly a decade from mid 2000s to 2015.

Enter the 4th Digital Revolution in the Travel Ondustry

The fourth revolution in the travel industry is about commoditization of the core mobility and travel services offered and their pervasive distribution in all possible digital and physical channels.

We are entering the mobility as a service area.

Travel is being commoditized and categorized as a mobility segment, offered as an Over The Top service (OTT) by software cloud platform based companies. In the western world this vision may seem heretic (except for Google), but in Asia it is already happening with Alibaba, and Baidu.

The new entrants, the mobility aggregators, are viewing themselves in the future as an OTT service, on top of mobility providers. Car providers for example, hit by the sharing economy and the fall of their sales, have started to re-invent themselves. Their strategy is now to make people use their cars (if they’re not buying them), their mobility platforms (payment, ticketing, and expense services), along with including software inside these cars to support their mobility platform. In short, they are conquering cities one by one and offering a one-stop shop solution for mobility.

At the same time, many city authorities worldwide have really been focused on being able to manage their city in smarter way and to gather information about their citizens, along with the ability to manage better mobility, by controlling demand and supply.

For example, the emerging TransLoc operating system can draw on traveler data in two key ways. First, it can inform agencies that some of their fixed route service might be made a lot more efficient, for example by changing the number of buses or routes that run at different times of the day based on ridership.

Second, the new system will be able to recommend where transit agencies can supplement existing fixed service with a more flexible, on-demand option. In the ideal situation, the new commute time would be closer to driving than riding the bus, but the new commute cost would be closer to a transit fare than a cab fare.

The 4th Digital Revolution Is Being Defined by Unicorns

“The Unicorns”, the billion-dollar tech startups were supposed to be the stuff of myth said Forbes. Now they seem to be, well, everywhere. AirBnb, GrabTaxi, SpaceX, Lyft, Uber, to name a few, are conquering the world by expanding their services at breathtaking pace, backed by hundred of millions of dollars, if not more.

Uber is so popular in Washington D.C. that the city authorities have decided to launch the development of its own “One City, One Taxi” app. This app should allow riders to e-hail cabs and drivers to be “visible” on the app while on duty. In France, instead of an app, it’s the open data approach that was imposed by law. All taxis could (on a voluntary basis) publish their position that could be retrieved by API by app builders.

Venture capitalists have begun targeting even bigger game, looking for startups with the potential to rapidly reach a $10 billion valuation, named “decacorns.”

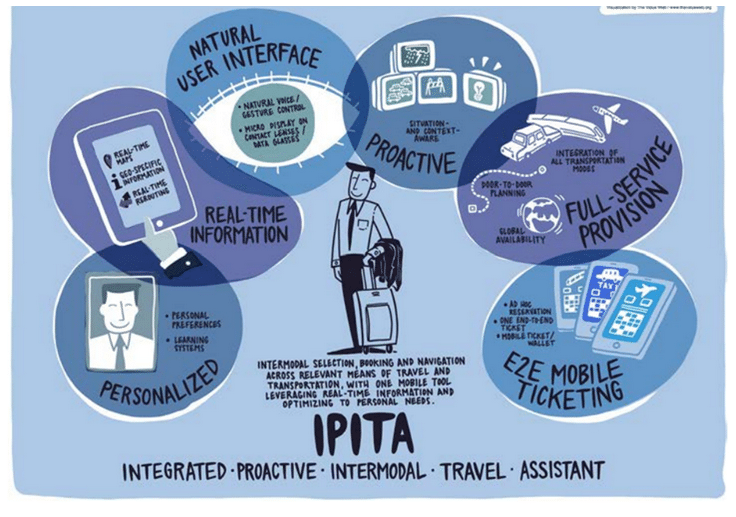

The Interactive Proactive Multimodal Intermodal Assistant

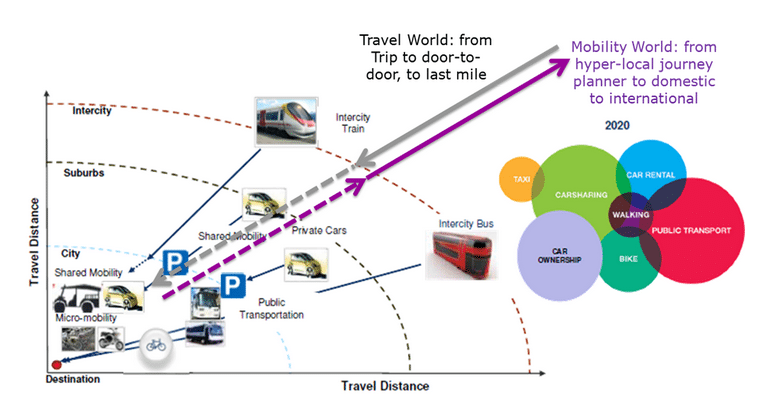

Since multi-modal door-to-door solutions are not yet covering the last mile and mobility journey planners are not offering to book air and hotels (for now), no solution exist yet that cover all mobility and travel needs.

The race is now on for mobility aggregators to build platforms and the associated tools on top of it, enabling a seamless real time door to door multi-mode of transportations solution.

The World Economic Forum named it the “Integrated Proactive Intermodal Travel Assistant” (IPITA).

IPITA is not a dream, several solutions already exist and are being tested in stealth mode by mobility aggregators. IPITA solutions are data hungry, and not all data are available yet, so before launching the long process of data gathering is on.

Academics are also working on it. For example, the new open source SIRIUS initiative, which aims to provide an end-to-end standalone speech and vision based intelligent personal assistant (IPA) service similar to Apple’s Siri, Google’s Google Now, Microsoft’s Cortana, and Amazon’s Echo.

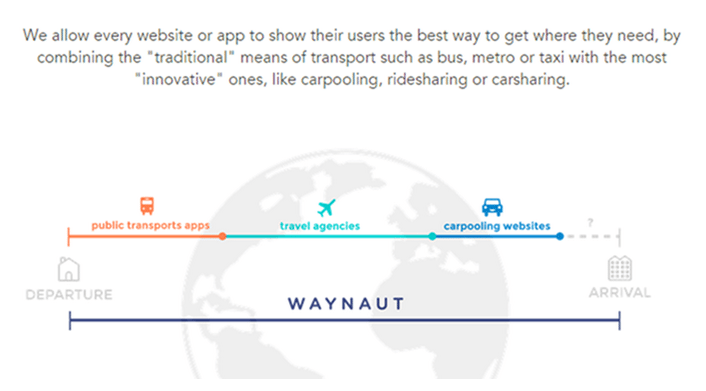

It is now a question of time before a mobility aggregators start offering a multi-modal door-to-door solution for domestic travel, especially between major cities they already cover. And startup like Waynaut are already trying to bridge the gap by offering an API and widget to add to existing websites.

The Traveler Fatigue

On the travel side, the wait is over. Gen Y travelers grew up with Internet and smart devices. Regardless of where they live, Gen Y passengers prefers to use online booking tools whatever device they use. Online Travel Agencies, metasearch sites like Kayak or Tripadvisor or corporate online booking tools like Concur or KDS never offered a seamless solution for searching and booking the last mile.

The traveler fatigue, revealed poll after poll, hasn’t yet found a correct answer. That’s why Google is still a major entry gateway for mobile search and why taxis could not compete with Uber. It’s about speed … and user perception of delay. The longer Uber exists in a city, the less patient consumers become, or said differently, Uber is making consumers impatient! Customer are now ready to shift very quickly to the best option that will be offered to them. This could lead to a whole new set of mobility habits.

Mobility aggregators are trying to provide the best user experience, by offering a seamless real-time journey planner to travelers in major cities. While on the go, the way to search for mobility solutions is to use the best local mobility assistant. Scout app for example, created in India, is able to check real-time availability of cabs across multiple service providers (Ola cabs, Uber, Lyft, Sidecar, Hailo, Taxiforsure) in one single app in major India cities. Once you have selected your nearest cab, the app will lead you to the relevant service provider’s app to complete the booking.

The other starting point for traveler is the agenda. Imagine if your scheduled appointments could be automatically enriched with journey times, if this information remains up to date, meaning you’ll always be neatly informed in case of delays or when a bus departs earlier than normal. Well, it’s already possible, at least in the Netherland, with Calendar42, a free app.

Mobility providers are creating new usages, new experiences. This is already impacting business travelers habits and the way they will search their daily trip, and at some point, any trip. The more they will trust their virtual assistant, the less they will go back to OTA and metasearch services for their trip, if of course they could be offered the right information.

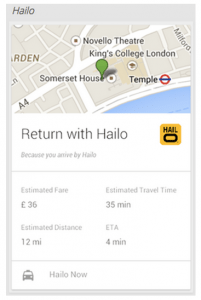

Will OTAs and metasearch providers be disintermediated by mobility aggregators? For private mobility providers like Uber and Hailo, opening their API is now key, in order to become a pervasive choice to urban dwellers, travelers and corporations.

Predictive Intelligence to the Rescue

Since software is eating the world, as Marc Andreessen said, and platform always win at behavioral change, all paths should lead to your platform: smartphones, watches, digital wristband, car infotainment, glasses. The question then is, how do you push offers in a pervasive and real-time way ?

Platform providers will always have one major advantage: they gather, aggregate and own data. Data is a must have for predictive intelligence and because they get more intelligent (and useful) by finding out more about you, they will become the only system that you trust.

The travel industry already learned that lesson with GDSs and OTAs, and that was the price they paid to not invest in a platform. Any GDS and OTA did provide great services and bookings, at the price of losing most of the user knowledge.

To be pervasive, travel and mobility provider companies have to invest into one or several platforms, and create ecosystems around them, to be visible and appear in search or virtual assistants proactive proposals.

Google for example, already offers native and proprietary management of travel information through Google search, email (with Gmail or Google inbox), calendar, proactive notifications and cars, via Android. Google will go even further by opening its contextual card based service, Google Now, to developers through an API. This will lead to a totally new way of interacting with travelers, outside of apps, and to move to a proactive card information push in-context. Hailo, the taxi service operating in London, teamed up with Google to introduce a Now card that will help make the commute a little bit easier for its customers.

Google for example, already offers native and proprietary management of travel information through Google search, email (with Gmail or Google inbox), calendar, proactive notifications and cars, via Android. Google will go even further by opening its contextual card based service, Google Now, to developers through an API. This will lead to a totally new way of interacting with travelers, outside of apps, and to move to a proactive card information push in-context. Hailo, the taxi service operating in London, teamed up with Google to introduce a Now card that will help make the commute a little bit easier for its customers.

The Power of Big Data

Finally, platforms are the best recipient for open transit and trips data, enabling big data analysis. Trip reconstruction and traffic analysis could lead to better mobility. For examples, Bridj provides a network of express shuttles you can book in advance or minutes before, SmarTaxi is used to anticipate the demand for a ride, and Urban Engines is using information from the billions of trips that people and vehicles make each day to improve its recommendations.

Going even further, ForCity provides a decision support service and forecasts mobility impacts for policy-makers and business decision-makers of the territories. And Xerox Mobility Analytics Platform (MAP) provides a new city-wide picture of transportation operations including adherence to schedules, passenger-loading levels and car park utilization rates.

The travel industry is also using platforms for big data analysis. WayBlazer is the latest example of a discovery system, built on top based on IBM Watson, that delivers “contextual, personalized advice and insights for travelers across all phases of their trip, from inspiration to transaction.”

Pervasiveness Through Unbundling and Deep Linking

Responding with a dedicated app to each user’s need, larger mobile applications are now being unbundled and linked, just like the web was before, through deep linking. Unbundling consists of splitting an app into several micro use cases, in order to maximise the chance for a user to access your information. For examples, Foursquare app is now focused on discovering new places and the other spinoff app, called Swarm, is focused on helping users share their location with their friends. Facebook and Yammer separated their social collaboration app from a Messenger app.

Since unbundling started to make app functionality thinner, someone had to invent a way to link applications between them. The objective being to lock the user in a galaxy of mobile applications loosely coupled. Each provider owns the customer, since each app requires to authenticate. URX goes even further by capturing the contextual information to find the most relevant actions for a user, using its own search engine, and to launch the right app or web site needed with the right parameters.

What Google Adwords brought into search, the same is happening with mobile deeplinking. Deeplink.me recently launched AppWords, a mobile search and ad platform that uses keywords to trigger relevant content between one app and another. Installed apps will then bid for displaying the ads in another app and link to them. For example, if you have an itinerary without any mobility provider for going from airport to city center, several taxi apps installed on your phone can bid for displaying their ad offer on your Itinerary.

We have to note that interactive mobility journey planner adopted an opposite approach, since it should provide a full and integrated solution to the traveler journey (from planning to booking to real time change while on the go), with a unified user experience. The switch to mobility planner is conditioned on the number of mobility options proposed and available on-demand. A meaningful “network” of services has to then be created, in a fair and sustainable way, and that’s exactly what cities are trying to “build” with the help of mobility providers. This will become even more effective when the self-driving cars, or “robo-taxis” will become available, further down the road.

Improving the Service Is Another Revolution

In the smart mobility and travel industry, offering technology is not enough, mobility providers and aggregators also need to transform the way they service clients. Proactive and intelligent options bookable immediately are a way to reduce the “traveler friction.” But it is not enough, and the incremental efforts needed to improving services is not delivering great results from now. In the mobility era, unhappy customers could harm tourism or lead to protest against city politicians. Offering the best and secured mobility services is now on most of local politicians agenda.

To improve the service, one of the option offered today is to enable a better communication between travelers, city transport institutions and transportation providers. In Paris, for example, each metro line has a Twitter account associated with it, and you can then engage with the RATP employees. Another option is to enable live interactions through conversations, each designed to interact and respond to an individual’s unique circumstances. It can be done using SMS or video call, and without an app.

Mobility Era Will Lead to New Ecosystems

The mobility era will force the travel industry to reinvent the notion of trip, historically far too static, and deliver seamless proactive and interactive solutions for the whole journey, including the last mile.

Some travel management companies are developing strategies to avoid being commoditized and to increase their profit. One solution is to split their operations into two separately branded entities, one for offering over the top SaaS solutions and the other offering standard and global travel agency services.

This is the case for Hogg Robinson Group that split the parent company into two and launched a new SaaS offer named Fraedom. GDS companies like Amadeus have already implemented this strategy some years ago, splitting GDS and technology, with great success. In all cases, travel management companies will experience hard times, since most of their clients are not ready to pay for new technology that they consider as part of the service to be offered.

Meanwhile, OTAs have already invested a lot in their platform and will sooner or later attack the mobility market — after they finish dabbling in restaurants and tours and activities — and will benefit from their global footprint and brand awareness.

Everybody wants to become the GDS of the mobility future, spending private funding and VCs money to conquer new territories and buying companies when needed, their big objective being to ensure future monopolistic position that will generate revenues in the future.

The smart mobility actors will continue to mesh territories and deploy their technology and services in each major cities of the world, before connecting them through a unified offer.

The chart below, from Frost and Sullivan Future of Mobility presentation, summarizes all these trend. It is only the beginning of a new era.

About the Author: William El Kaim was till recently the Technology Marketing Director of Global Product Innovation at Carlson Wagonlit Travel in Paris, where he contributed to the invention of several travel products and filed a patent. Currently on sabbatical, he specializes in technology innovation in the transport and travel industry. He holds a Ph.D. from University Pierre and Marie Curie (Paris, France) in software engineering.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: mobility